Google is facing anger from the German startup ecosystem for refusing to restructure ad payments linked to travel and transport bookings that were subsequently wiped out by the coronavirus crisis.

TechCrunch has seen a letter addressed to Google that’s co-signed by eight travel industry startups in which the tech giant is asked for flexibility in how it enforces payment terms around these earlier ad auctions.

“By selectively enforcing strict payment terms on larger partners — especially from the travel and transportation industry — for its services provided to market those products, Google is opting out of sharing the responsibility to do right by consumers,” writes Christian Miele, the president of the German Startups Association — on behalf of the CEOs of Dreamlines, FlixBus, GetYourGuide, Homelike, HomeToGo, Omio, Tourlane and Trivago, who are co-signatories to the letter.

The eight startups represent €75M+ ($80M+) in ad revenues for Google in Q1 2020, per the letter.

The startups go on to call on Google to “share the burden”, noting that “leading companies from Germany and around the world have gone to unprecedented lengths for consumers” — such as issuing no-questions-asked refunds as a result of what it calls the “current extraordinary global situation”.

Globally, the travel industry has been decimated by the coronavirus crisis with demand evaporating almost overnight and no realistic prospect of the sector recovering until at least next year — plunging travel startups into a nuclear winter.

At specific issue here is the startups say Google is demanding payment for ads attached to bookings they subsequently refunded. Such as, for example, Easter trips and tours booked earlier in the year before the pandemic had taken hold in Europe.

This means the startups are now on the hook for substantial payments to Google for bookings that did not convert into revenue for their own businesses.

“The conflict is with the advertising dollars that we paid to Google for customers that could never be converted,” explains GetYourGuide CEO Johannes Reck. “People typically book two to three weeks out when they book for transport, hotel. It’s a little bit closer for experiences but particularly in the pre-Easter season… there are lots of booking volumes that come through Google and are then booked.

“We held the cash from these bookings and then the entire lockdown happened. Naturally what we did it after the lockdown happened is that we refunded all of the customers which were pretty significant amounts of money but which was obviously the right thing to do because they couldn’t travel — they had to stay at home.”

Reck says that when GetYourGuide went back to Google — to ask for at least a discount on the payments or else for them to be restructured so the business would not need to pay until travel picks up again — Google point blank refused.

“Google said A) we’re not going to participate in the cancellations at all — that’s all your thing to do, your customers, basically. Despite the fact that [they] can track every single customer. They know exactly which customers came from Google. And B) we’re also not restructuring the payment terms — so you have to pay immediately, within thirty days,” Reck told TechCrunch.

“That’s obviously terrible because all of our employees are on short term labor programs right now.”

“To me it’s inexplicable that we have to carry the full burden while the most profitable company in the world that has received more than €500M from us last year doesn’t want to do that,” he added. “That to me is just wrong.”

We reached out to Google to ask about the payments but at the time of writing the company had not responded.

Google’s parent entity, Alphabet, reported earnings yesterday, disclosing a significant slowdown in its ad business in March. However it still reported $41.16BN in revenue for the quarter — beating analyst estimates. Earnings per share did not do as well as expected, though, coming in under expectations at $9.87 in per-share income.

Ads remain the primary money engine for Alphabet, with Google generating the bulk of its revenue and profit, which are in turn largely generated by ad incomes. So the tech giant is exposed to the coronavirus crisis, as marketing budgets are put to the torch — though its multi-billions in revenue make it considerably less exposed than startups that advertise on its platform.

Aside from the raw impact of an unprecedented crisis hammering these smaller businesses, there’s a specific political dimension to the startups’ complaint — given they are in receipt of financial aid from the German government which is providing funds to support wage bills during the coronavirus crisis.

So now there’s the prospect of taxpayer funding flowing into Google’s coffers — instead of helping startups retain their staff.

“We’re currently getting governmental credit and now the governmental credit would basically need to be paid out to Google to fund advertisment bills for customers that could never be legally converted, so we are pretty outraged,” said Reck.

The German government laid out further details of a separate €2BN financial support program today that’s specifically intended for VC-backed startups and SMEs — and is slated to start delivering support funds next month. Though, again, the startups’ concern is the intended relief won’t help them unless Google agrees to defer the ad payments.

Asked whether GetYourGuide might need to make staff redundant if Google refuses to restructure the payments, Reck said: “So far we have not. And for the eight companies that sent the letter I think the situation is different. Ultimately we would get governmental credit — and that governmental credit would be used to pay Google.”

He also pointed out that other tech giants have been flexible over similar payments.

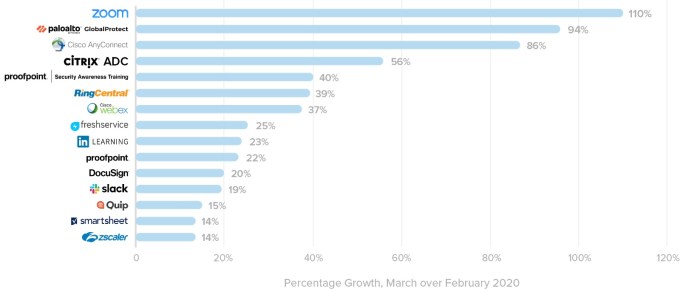

“It’s really striking because they are very isolated,” he said of Google. “Facebook, Microsoft, every other company was very forthcoming with travel and transportation companies in this pandemic. They all say pay whenever you’re ready to pay — don’t worry about us, get through it first. Facebook even gave additional ad discounts for the future when we want to reboot.

“So to me it’s staggering because the group of companies that wrote the letter spent more than half a billion dollars last year on Google. And still they’re not willing to do anything for us.

“At the end of the day Google needs to step up to their responsibility,” Reck added. “If you’re even benefitting from people losing jobs in this pandemic I think that’s just completely wrong.”

Discussing the matter in a telephone call with TechCrunch, Thomas Jarzombek, commissioner of the Federal Ministry for Economic Affairs and Energy for the Digital Industry and Start-ups, told us the German government raised the issue of the ad payments in a call with Google yesterday. He said Google told it it would be dealing with such requests on a “case-by-case” basis, which Jarzombek described as a concern — given the lack of transparency around its decisions.

“In Germany there are a lot of companies behaving in some kind of social manner to support the ones that are not that strong financially,” said Jarzombek. “When we look at Google it’s obvious that this is one of the financially strongest companies in the world. And what I’m more concerned about in that case is that Google told us they will decide ‘case by case’ whom they will help out.”

He said the issue is one that’s likely to affect startups more than “traditional” types of businesses which are likely to be spending less on Google ads.

“For these digital startups the amount they’re spending on ads on Google and on Facebook is maybe the biggest share of their cost position,” he added. “So to be honest we are afraid that this can be a disadvantage for them.”

He also raised the spectre of competition — saying the concern is Google’s case by case decisions may be less favorable for startups that are “in some kind of competition” with the tech giant.

“There are other companies that are in competition with all these Google verticals… and it may be in these ‘case by case’ decisions Google will not be very kind to them,” he suggested. “So this kind of procedure is completely intransparent to us — and also to the companies.”

In recent years Google has faced substantial antitrust scrutiny and enforcement in Europe, related its dominant position in the search market — with the European Commission levying a number of fines, including related to Google Shopping and search ad brokering.

The Commission has also previously said it has received a number of complaints about the tech giant’s activities in other verticals — including travel search — though so far without launching a formal probe.

Jarzombek told us the German government has not currently raised the issue of Google’s selective response to ad payment restructuring with the Commission, as it’s not yet clear how the company will respond to the calls for a rethink — saying it’s waiting for a “final response” from Google to its concerns.

But he emphasized he remains concerned about the lack of transparency around Google’s processes, reiterating: “The procedure is intransparent for us and also intransparent for the startups.”

Asked if GetYourGuide has any competition concerns related to Google’s response towards the travel startup sector, Reck told us: “We’ve just been a very happy Google partner up to this point. We’ve done tremendous work with them. Antitrust is mostly regarding flights and hotels — it’s not experiences. And we have always had a very good relationship with them which is why I’m so absolutely baffled that in the worst hour of our company history they currently completely changed behavior and become so aggressive.”

While there may be no legal requirement for Google to amend contractual terms around the payments, even during a pandemic, Reck says the bigger point is simply about doing the right thing.

After all, this is a company that used to attach itself to the motto ‘do no evil’.

“Google never wants to give in on any of these things — out of principle. But I think their principle here is just misguiding them into a completely wrong direction because according to their principle we should never have refunded customers and then everything would be fine. But that doesn’t follow the logic of a pandemic where everyone has to stay at home,” said Reck.

“I don’t even want to get into the legal argument on this because I think just morally it’s wrong,” he added. “As [one of] the most profitable organizations in the world you cannot charge startups who are furloughing their employees and put them on short term labor programs and who are basically now getting subsidized by the government — those subsidies can’t flow back into Google.”