Today Y Combinator kicked off the Demo Day cycle for its Summer 2021 cohort. The collection of early-stage startups on day one-of-two alone numbered in the hundreds, meaning that we had to assemble a team here at TechCrunch just to cover it all.

But before we get into notes on each company that presented, a few notes on the cohort itself. Per Y Combinator leadership, the 377 (!) startups in this cohort have founders from 47 different countries, and 37% of the founders in this cohort were from underrepresented groups (which YC’s Michael Seibel says the accelerator defines as Black, Latinx or female.)

The international breakdown of the batch parallels that of this past winter. Nearly 50% of YC startups are based outside of the United States, with India, U.K. and Mexico making up the largest part of that percentage.

What follows is a list of the 180+ companies in the order that they pitched, and our notes on each pitch. TechCrunch will follow up this post with a list of our favorites. So, enjoy the below and happy hunting to all the founders and investors!

(Oh, and if you’re somehow hungry for more, don’t worry: another equally huge batch is scheduled to present tomorrow.)

Day One Companies:

Endla: Software meant to increase production and reduce costs associated with oil/gas wells. The company says it can save about $40,000 per well per year.

Phykos: Autonomously grows seaweed to capture carbon, selling offsets to companies to uphold their climate commitments. Built by GoogleX mechanical and software engineers.

MadEats: MadEats is an online ghost kitchen food delivery service in the Philippines. It has built several major local restaurant concepts and is building affordable, high-margin brands to serve direct to consumers.

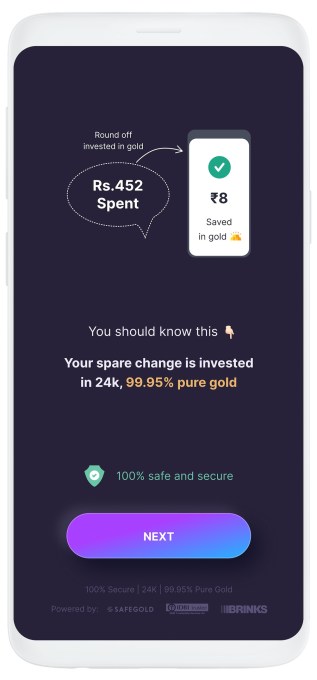

Financial Choice: Financial Choice wants to boost the yields that consumers can earn from their checking accounts. In today’s market, cash earns incredibly low yields at rest. So, Financial Choice wants to invest checking account funds, while preserving access for users for when they need their money. The startup claims to have reached $4.4 million AUM thus far. We’re curious about the tax implications of the model, but the concept of earning more yield from liquid holdings is attractive.

Atlas: This startup is building software to let restaurants in Southeast Asia move more operations online, aiming to help restaurants create a closer bond with consumers that food delivery platforms have pulled away.

Apollo: A debit card that rewards users with stocks. Making purchases with the card earns the user a fractional share of a stock, plus “a chance to win” full shares.

Strive Education: With 3.7 million students in Asia, Strive Education uses 1:1 live classes to teach high school math through coding games. The company has $20,000 monthly recurring revenue and is growing 30% monthly.

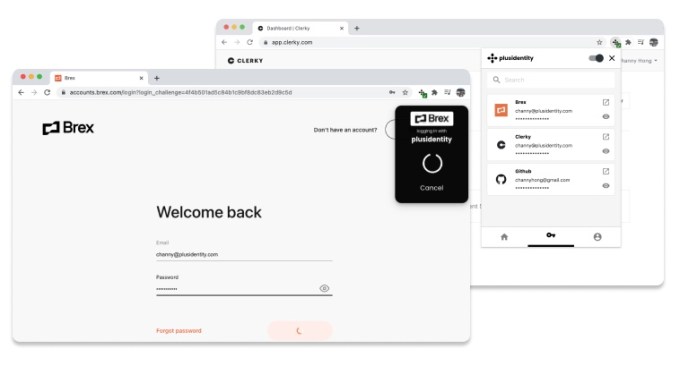

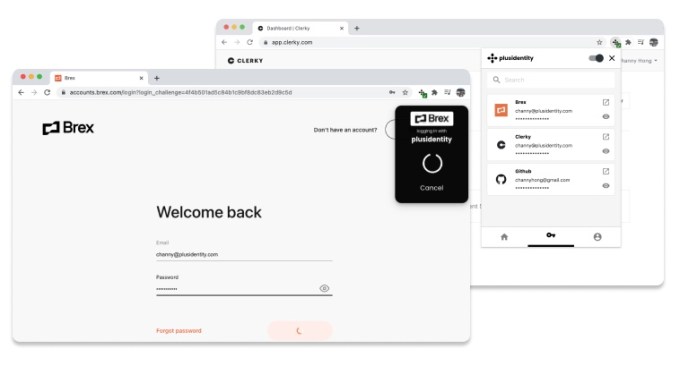

PlusIdentity: A password manager for startups, focused first on a Slack app that hits the high points of enterprise-level options (Okta) and consumer apps (LastPass). Only one month old, they already have 10 startups signed up and aim to be the next identity management platform for the startup world.

HitPay: HitPay brings together two startup trends that have captured investor interest in recent quarters, namely no-code tooling and payments. The company wants to help SMBs in the South East Asian market accept payments from what it describes as a market that is fragmented. So far the company has reached $5.4 million in total payment volume (TPV) per month, a figure that yields $35,000 in monthly revenue.

AOA Dx Inc.: AOA is building blood tests that help detect ovarian cancer early when survival rates are much higher. The founding team has two successful exits in the health startup space behind them and their product has already shown early success in a 600-person patient study.

Cococart: An online store builder that claims to have a setup process 10x faster than Shopify. The team says they’re currently working with over 2,000 active merchants.

Metaphor: What’s the metaphor for taking on Google? Metaphor is a language-model-based search engine. With this technology, users can search by ideas; think queries like “one of the most promising startups in the health tech space is” or “a smart essay about love is” instead of relying solely on keywords.

Tinai: Ninety percent of small businesses in Vietnam still keep at least some of their financial records using pen and paper. Tinai aims to help modernize this with a digital bookkeeping service — and after only six weeks they have 1,200 active merchants and are handling USD$1.8 million worth of transactions.

Turion Space: Space trash removal! It’s a well-known issue that the orbit around Earth is littered with crap of all sorts, junk that is circling the planet at high speeds. Turion Space wants to build spacecraft that can get that shit out of orbit, and it also wants to service satellites and mine asteroids. You have to start somewhere, we suppose. Space companies are hard to judge at this stage, but we can say that the TAM Turion is pursuing is, well, as big as the planet.

Cero: The team at Cero is building software to help hospitals automate communications with patients over WhatsApp. The team has banked $95,000 in monthly revenue helping their customers communicate with more than 600,000 patients.

Aqua: Investment platform to allow individuals to invest in private equity funds without requiring them to have a ridiculously high net worth.

Warpfy: Built by the founders of Wayfair Asia, Warpfy is on a mission to acquire and grow e-commerce stores into global brands. It will help brands bring distribution multichannel, breaking out of a tradition of Amazon roll-ups as a key way to grow.

Momo Medical: With a growing elderly population worldwide, nurses in hospitals and long-term care facilities are stretched thin. Momo Medical has made an IoT-equipped bed sensor that tells nurses who is sleeping, who is rising, and who may be having trouble, all in one interface. The increase in productivity could help offset the worldwide nursing shortage. They’re already signing contracts and have $250,000 ARR.

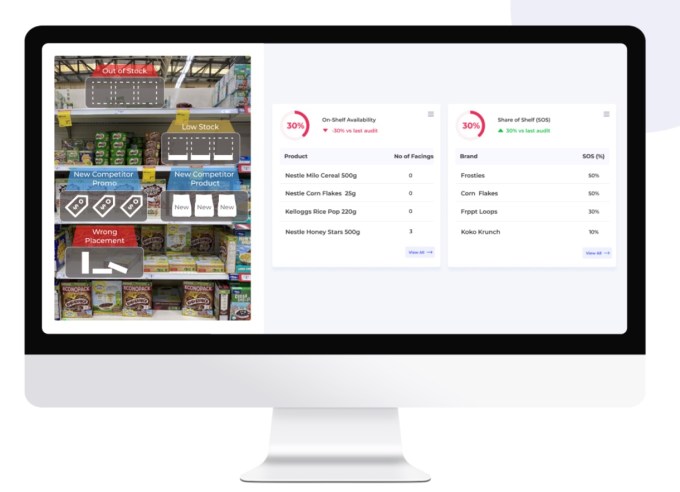

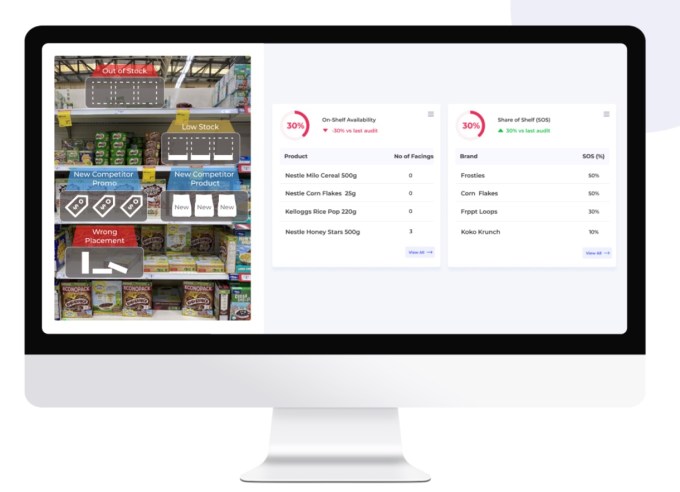

Milky Way AI: No, Milky Way AI is not building computer intelligence to scan the stars. Instead, it’s building computer intelligence to scan the shelves. Perhaps Milky Way refers to the candy bar, instead of the interstellar body. The startup has built a mobile app that allows CPG companies to scan shelves and check what goods are in stock. Per the startup, it has four brands working with it today wirth $11,000 in monthly revenue. And two new contracts that could push its revenues into the seven figures.

Slip: Slip is building a marketplace for top developers to create and monetize courses helping young coders hone their skills. The team is looking to get their product into the corporate learning space and get major tech companies providing their courses to employees.

MindFi: A corporate wellness/mental health platform for companies in Asia, offering employees “microclasses,” guided exercises and assessments meant to help with mental well-being.

Opkit: Founded by early members of Brex’s engineering team, Opkit helps surgery centers optimize how they buy medical devices. The tech plugs into health electronic systems and then provides dashboards that illustrate which surgeries are the most expensive for the center. Then, the purchasing software gives recommendations on what customers should buy to limit costs.

Deskimo: With employees fluidly moving from home to office to shared workspaces, hybrid work is a global trend. Deskimo aims to embrace that flexibility by aggregating managed office space into a single app and renting it out by the minute. They’re launching in southeast Asia first but hope to become a global hybrid work platform.

Lumify: We’re all familiar with the concept of super apps for consumers. First popularized in Asia, they may bring together ride-hailing, food delivery, e-commerce and chat. But what about a super app for nurses? Lumify thinks the idea has legs. Its app can help nurses find whatever they need, from scrubs to shifts it claims. The company has generated $275,000 in revenue so far this year from a userbase of 15,000 nurses. The concept makes sense. Nurses are busy, in demand and earn good wages; why not sell to them?

Crew: Crew is building a recruiting-centric CRM designed to make it easier to reach out to candidates. The company’s software is designed to help recruiters tackle proactive outreach with tooling designed for each part of the hiring process, keeping things streamlined and personalized.

Akute Health: Akute makes a medical records management system for the ever-increasing number of digital health companies, so each one doesn’t have to reinvent the wheel. Founder Sharud Agarwal says Akute has 40 customers accounting for a total of 20,000 patients.

Writesonic: AI-powered copywriting tool for marketing material. Launched in February, Writesonic hit $36,000 in monthly ARR through 100% organic user acquisition.

REPROSENT: Cancer patients’ daily symptoms could be crucial to understanding their needs and the effectiveness of treatment, but it can be hard to collect them regularly. Reprosent is an app for patient self-reported data that has seen over 80% daily use, providing a steady stream of helpful data for caregivers. They’re already signing up major care centers.

Pinglend: This is an interesting company. Pinglend wants to let people pledge items and, in return, offer credit based on those assets. Per the company, its model will allow it to loan money to users at around 20% of the rate that pawn shops or payday lenders charge. The company has yet to launch, but as it is playing in a space rife with consumer abuse, it will have questions over its head as it proves out its model. The company wants to “graduate” its users to unsecured credit cards in time.

AppX: AppX has built a platform that helps social media creators build their own apps that play to their strengths and monetize their audiences better than personal websites do. The company started with educational creators and is looking to expand with gaming and fitness creators.

Caire Health: AI meant to help “diagnose brain bleeds in seconds.” Co-founder Anmol Warman says he expects FDA approval within six months, and the company is currently running trials with multiple hospitals.

Membo: A premium way to grocery shop. Membo is a next-day grocery delivery service in Europe that optimizes for freshness and quality, instead of 15-minute speed. The startup does $30,000 monthly GMV and makes money through a per-order commission fee.

Soraban: Accounting firms aren’t the most futuristic office environments, and Soraban aims to modernize them with a back-office platform that brings them into the 21st century.

Abatable: Robo-advising is old hat by this point, technology that has become table stakes for consumer investing services that focus on long-term holding. But Abatable wants to bring robo-advising into the carbon-removal game, creating portfolios that “focus on carbon removal.” Given the rising focus on more socially and environmentally conscious investing around the world, it’s a neat idea.

Varos: Varos helps companies understand how their performance stacks up against the competition by creating anonymized databases of customer data. The startup is tackling the $21 billion planning software market with a specific focus on marketing, product and finance teams.

Friz: A bank specifically tailored for freelancers (focusing on South Asia and Southeast Asia), making it easier to get loans for those without fixed monthly paychecks.

Zensors Inc: Google analytics for the physical world. The startup is a software-only AI solution that connects to security cameras dispersed around airports, transit hubs and stores — helping companies offer actionable advice to better the customer experience. Its software footprint currently impacts over 1 million people a week.

Kodda: Getting insurance in LatAm is a dated process, and Kodda aims to bring a Lemonade-like experience to the millions of people there. Users can sign up in 90 seconds and make claims in minutes; so far the company has 250 paying customers and it says not one has left.

Cache: Gopuff is a big deal these days, having raised roughly eighty zillion dollars. But the Cache team thinks that there is still room in the on-demand market for convenience goods. The startup operates so-called “dark” stores to give goods to on-demand drivers. Dark stores in general are a hot commodity these days, thanks to rising delivery needs.

Akudo: A neobanking startup in India geared toward providing teenagers with credit cards, hoping to help young people in the country manage their money in a smart way. The company combines a credit card, savings account and rewards with tools to help increase financial literacy.

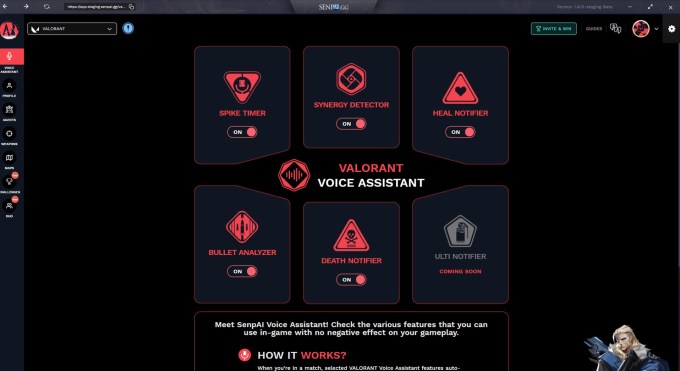

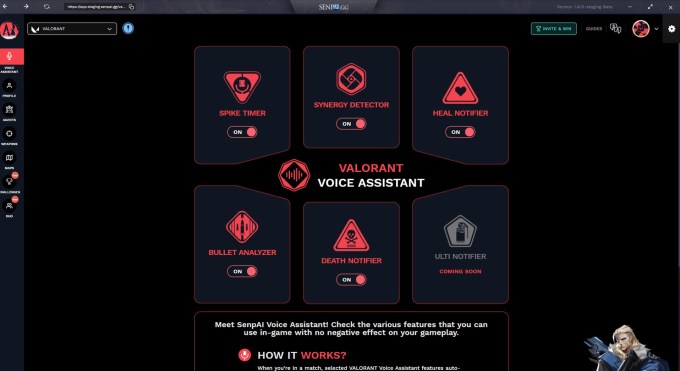

Image Credits: SenpAI.GG

SenpAI.GG: AI-powered video game coach. They’re building a tool that uses overlays and a voice assistant to help you figure out the best move to make, or the best character to pick. Olcay Yilmazçoban says they currently have over 450,000+ monthly active users and are seeing 20% growth month over month. See our previous coverage of SenpAI here.

Iona Mind: Iona Mind is a mental health app that wants to teach people how to overcome anxiety and depression. The company’s content is derived from evidence-based protocols and Cognitive Behavioural Therapy (CBT). The platform is sold directly to employers that are growing their benefit programs and searching for ways to boost engagement.

Storylane: Selling a digital product or service is a lot easier when the customer can try it for themselves. Storylane lets marketing teams deploy personalized product demos to prospective customers, which they have found increases conversions considerably.

Ivy Homes: Opendoor is worth more than $10 billion as a public company today, so it is not a huge surprise to see a startup working on bringing the model to other countries. Ivy is taking the concept to India, where it claims the real estate market is obscured by a lack of information. The company has secured a $500,000 credit line and has bought its first property. So, it’s early days for Ivy, but given the scale of the market they are taking on, that’s no sin.

Liv Labs Inc.: The startup is building fitness programs that help women deal with incontinence, building exercise programs that help women strengthen their pelvic floor muscles and decrease risks of pee leaks, an issue the startup says 27 million American women struggle with.

Sitenna: Helps wireless carriers speed up the process of finding new sites to put up towers — a particularly well-timed idea, as 5G requires considerably more towers to work well. The company says it can shorten the process of finding a location from 24 months to 6 months. Read our past coverage of Sitenna here.

Ferveret: Ferveret, inspired by nuclear plants, has created a liquid-cooling technology for data centers. The startup helps reduce costs and carbon footprint while improving server performance. So far, Ferveret has landed two paid pilot contracts with Enel and Crusoe Energy.

Coulomb AI: Electric vehicles run on batteries, and batteries degrade with use — but exactly how much? When should companies replace theirs? What’s the cost of preventative maintenance? Couloumb AI aims to provide battery analytics for any and all EV companies (focusing first on fleets in India and government applications) and hopes to become the standard analytics platform worldwide.

Arengu: If the startup market can support a host of companies just working to improve checkout flows, there may be room for tech upstarts just focused on sign-up flows, right? That is the bet at Aregenu, which is building signup flow for other companies. Its pitch noted that a host of major companies devote whole teams to this work, something it points out that smaller firms can’t afford. If the fundraising history of checkout companies is any indicator, we expect Arengu to raise a mountain of money by Thursday.

Yemaachi Biotechnology: The biotech startup is aiming to diversify the cancer diagnostics and therapeutics testing pipeline by collecting and sequencing samples across Africa, an effort to help Africa’s genetically diverse population get more accurate treatment. The founding team has decades of experience in the health research field.

q&ai: Analyzes company sales calls to provide insights for the sales team to help them tune messaging.

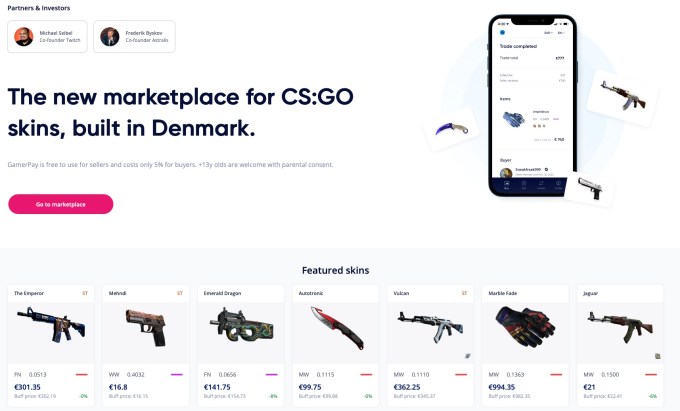

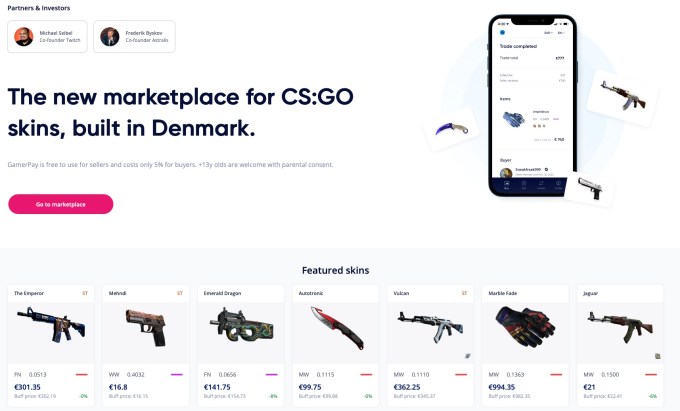

GamerPay: An escrow-style system for selling digital items and skins in games (starting with CS:GO) to hopefully reduce the rampant scams.

BluumBio: Companies are under pressure to reduce their environmental impact, and BluumBio allows them to do this simply by seeding bioengineered plants and bacteria at sites polluted by microplastics, heavy metals or petroleum byproducts. These engineered organisms have regulatory approval and are heading to their first field trial this fall, and the company already has lucrative partnerships lined up.

Goodkind: I hate being called on the phone, so I am not exactly sure if promising me that in the future more companies will video call me than ring me up is a great idea, but Goodkind thinks its vision of the future is going to be big business. Powering video messaging for “B2C teams,” the company has racked up $375,000 in ARR, a figure it claims is growing by 28% on a month-over-month basis. That figure could rise if its pipeline comes through by a factor of more than two.

Matidor: Matidor is a project management platform combining geospatial data with team collaboration software. The startup has $80,000 in ARR and is chasing the $4 billion natural resources market.

Promakhos Therapeutics: Promakhos is a therapeutics platform focused on curing inflammatory diseases using bacteria. The company’s first drug is focused on reversing symptoms in Crohn’s disease patients. They’re also looking to help patients suffering from multiple sclerosis and Type I diabetes.

Whaly: A no-code platform for modeling your business data, automatically imported from tools like Hubspot, Google Ads, Google Analytics, etc.

Vital: An API for collecting at-home health data. Using at-home lab tests and fitness wearables like Oura or Fitbit, Vital aggregates data without requiring one to step foot into a doctor’s office. The developer-designed API is currently in closed beta.

Moving Parts: Rebuilding your UI to accommodate new features or migrate to a new code base can be costly and time consuming. Moving Parts is a component library from former Apple and SoundCloud designers full of “Apple-quality” UI bits and pieces that companies can drop in and customize to cover common needs like sign-up and log-in processes.

Monet: The concept of getting workers access to their earnings ahead of traditional paydays is heading to Latin America thanks to Monet, which claims its service will work with any worker in the region who has both a bank account and a salary. No employer buy-in required. That’s frankly pretty cool. Monet claims to have 6,000 users waiting to use its service. That should be enough early demand to prove its model. Let’s see how it scales.

Enerjazz: A battery-swapping network for the 2 million electric vehicles in India. The company is hoping to build out a sizable network that’s well positioned to cater toward the electrifications of India’s 8 million rickshaws and 187 million scooters.

Ivella: A bank for couples, beginning with a debit card that automatically splits expenses between two users.

Malloc: A mobile app that prevents other mobile apps from recording and sharing data without the user’s approval. It notifies users when a mobile app uses their camera or microphone and offers a monitoring console to understand how long those features are being used. Malloc’s spyware tracker has 80,000 active users and over 100,000 users to date.

Flowbo Inc.: Flowbo wants to help creators access funding, fast. Instead of forcing creators to rely on payment from traditional brand deals or sponsors, they can upload proof of those income streams to get a loan upfront. Then, creators are invited to pay money back over time through a percentage fee based on total monthly revenue.

Synth: Synth is building software to help knowledge workers better recall the information that they consume, be it in video format or text. The founder said that current software products like Roam just don’t cut it. We’ll need to play with this to truly understand it, but the concept is neat.

Humane Genomics: The startup is building a development platform for making artificial viruses focused on cancer therapeutics. The team has helped design hundreds of unique oncolytic viruses and was previously working on a COVID-19 vaccine candidate that it recently discontinued efforts on.

Mailmodo: A no-code platform for easily building forms and widgets to embed within emails.

SafeBeat Rx: SafeBeat Rx wants to replace hospitalization for new arrhythmia patients through its take-home kit that combines EKG software with FDA-cleared hardware. While the concept of software replacing a hospital stay may seem like a moonshot, the startup recently completed a 103 patient pilot to test out its hypothesis. It estimates that the take-home kit will be on the market within one year.

Karbon Card: It’s Brex for India. With $110,000 already coming in monthly and 1,100 companies already signed up, this is about as sure a thing as you’re going to find in this list. Expect a trillion dollar valuation by the end of the week.

Digistain: One of several startups in this cohort taking on the cancer market, Digistain wants to use infrared scanning to better understand which breast cancer patients are truly a fit for chemotherapy. Its view is that more folks than needed get chemotherapy, which is not only expensive but can actually kill you. I am not an expert on regulatory approval, but using tech to avoid taking poison juice to the jugular sounds pretty great.

Odwen: Odwen is building a massive warehouse network in India, aiming to leverage underutilized space at existing warehouses with a tech-enabled platform that helps users with storage needs find their own solution across a wide network.

Rinse: Pitched as “One Medical for dental,” Rinse is looking to make it easier to book same-day dental cleanings and exams — because more checkups = less drilling.

Swipe: A billing and payments solution for Indian small and medium-sized businesses. The over 1,000 businesses that use Swipe today are able to create easy invoices, WhatsApp-friendly payment links and more. Swipe has hit over $1 million in monthly transaction volume. As my colleague Alex Wilhelm put it, Swipe is Stripe, with a W.

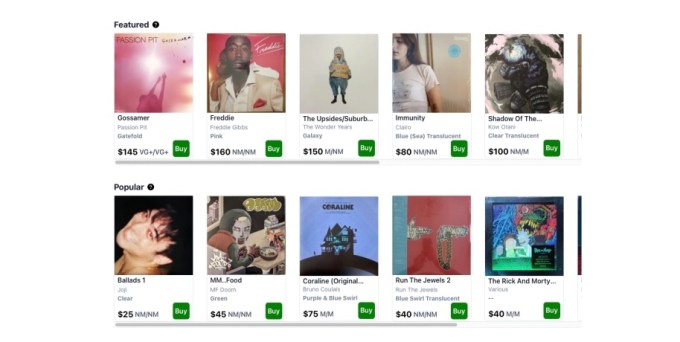

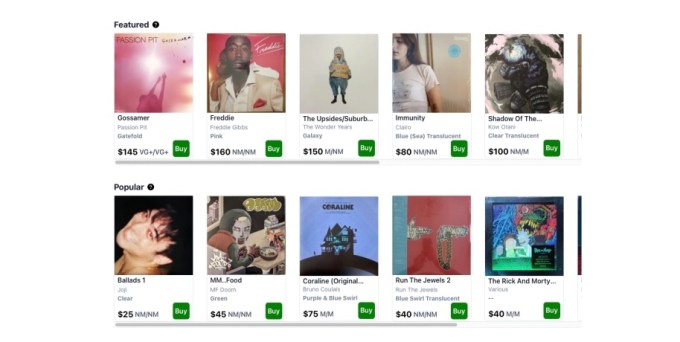

Nasdisc: The market for vinyl records has exploded over the last couple decades as these collectibles have reentered the vogue. Nasdisc thinks it’s time for a modern, dedicated vinyl marketplace like those that exist for sneakers and other hot C2C goods. They’re live now and doing $1,000/week in sales, so maybe it’s time to pull out those old records and make a buck or two.

PropReturns: Working against a similar problem set as Ivy Homes, PropReturns wants to bring more data to the Indian real estate market, which it also views as somewhat poor today. But instead of buying homes, PropReturns wants to facilitate transactions. It has facilitated some $3.9 million in property value. That generated $74,000 in revenue. Let the Make India’s Property Market Better Startup War begin!

DiveHealth: Dive helps migraine sufferers find the right treatment among the dozens of migraine drugs on the market today. Users take a genetic test, fill out a questionnaire and receive a custom treatment plan. Twenty million Americans currently suffer from migraines, so it’s a huge opportunity.

Zinite: This team wants to help companies build better performing chips within the same product real estate with what it says is “only high-performance transistor which can be built along the z-axis.”

Kiwi Biosciences: Built by an IBS patient and former IBS digital health founder, Kiwi has created an enzyme that helps customers digest food better by breaking down common dietary triggers. It charges $50 a month for the patent-pending enzymes — and as of last pull, Kiwi has $23,000 in monthly recurring revenue.

Algen Biotechnologies: Born out of CRISPR co-inventor Jennifer Doudna’s lab, Algen aims to treat cancers with no known effective drugs by applying machine learning to RNA messaging and finding ways to change it. They’ve already found one oral inhibitor for one such cancer and aim to enter clinical trials within 18 months — and of course Big Pharma is already sniffing around.

Kalam Labs: Kalam Labs wants to use games to help kids from 6 to 14 years old learn STEM. Targeting the Indian middle class, the company has racked up 1,500 paying customers and has reached $15,000 in MRR. The company won’t expand north to China, however, as that country is cracking down on paid edtech services. And cutting back on gaming hours for minors. Whatever. The edtech market in India is hot, and this could fit into it neatly.

Pillar: Pillar is building a health coaching platform to help Americans live healthier lifestyles and minimize costs associated with lifestyle-based diseases. The startup is aiming to build a solution that easily plugs into corporate health platforms, allowing clients to easily access health coaches.

SalaryBook: Pitched as “Gusto for India,” SalaryBook helps SMBs in India handle payroll, employee attendance and expenses. The company says it has 80,000 employers on the platform already.

Coinfeeds: Former Robinhood and Uber machine learning specialists are building a Bloomberg for crypto. The startup tracks and aggregates news, as well as social sentiment, for crypto enthusiasts. Users can customize their news feed to get specific information about their portfolio coins and also track broader trends such as upcoming tokens and legal developments.

Gobillion: Gobillion is taking the highly successful Pinduoduo model of group purchasing and applying it to India’s daily grocery buyers. Customers can band together and save 25%-40% by purchasing in bulk — and the team, vets of India’s e-commerce world, know how to get the retail giants on board.

Commery: An interesting flip on the commercial real estate marketplace. Commery lets tenants submit an ask for real estate, which brokers work to match. Brokers pay the startup. So far it has snagged 25 listings. The timing of this company is interesting thanks to a shift in the world away from IRL work, but as Commery also works with industrial spaces it could still have a market to sell into.

Neodocs: Neodocs is building a platform for instant lab tests that users in India can complete with their smartphone. The company has created a test helping track parameters with insights on liver health, kidney health, digestion, hydration and more.

Mentum: An API for fintech companies in Latin America to offer investment services. Currently available in 13 Latin American countries.

Nino Foods: With over $165,000 in monthly revenue, Nino Foods is building a cloud kitchens service for premium brands in India. Brands using Nino include Francesco’s Pizzeria and Nino Burgers. The startup is already profitable in three Mumbai locations.

Banner: Commercial real estate managers are handling billion-dollar projects in Excel, where a transposed digit or errant click can lead to a multimillion-dollar error. Why not have an OS for commercial real estate that makes it safer and more convenient? Oh, that’s what Banner is? Great!

Pideaky: A Square for Latin America. The startup helps neighborhood corner stores digitize payments, billing and internet operations, ultimately increasing revenue for these customers. It has $42,000 in monthly recurring revenue and is growing 30% monthly.

Talus Bio: Talus Bio is a drug discovery biotech startup focused on studying gene regulatory proteins in their natural cell environments. The company hopes this new platform will help further grasp the role of these proteins in various diseases and facilitate therapeutics that tackle them.

Freterium: A collaborative platform for managing shipments and transports, aiming to replace the complicated spreadsheets the industry uses today.

Nabla Bio: The startup co-develops antibody drugs “that are more likely to get approved” with pharmaceutical companies. The company has partnered with three top-tier companies resulting in $800,000 in revenue.

Clear: Skin care is super important to a whole lot of people, and they happen to also spend quite a bit on it. Clear is a debit card just for cosmetics and skin care, giving cash back on numerous brands. But it also grants access to a social media community of skin care enthusiasts who can share their routines … full of useful data for cosmetics companies, too!

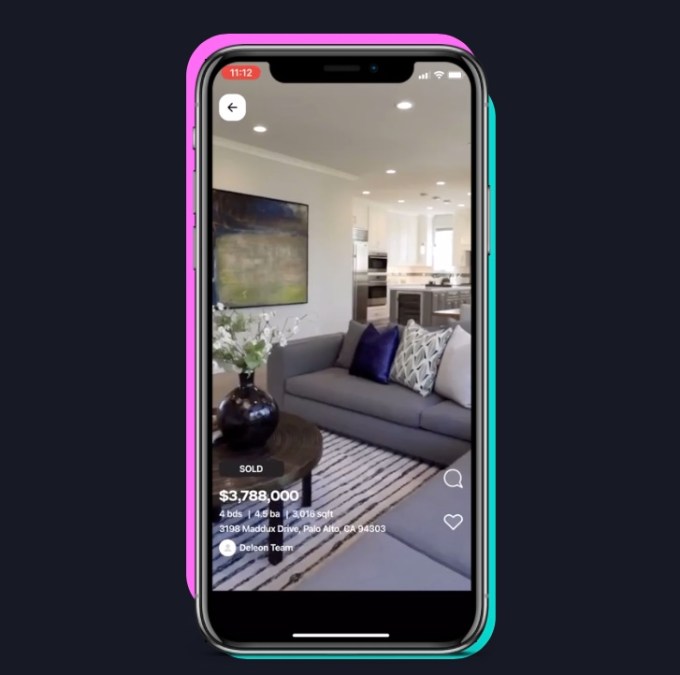

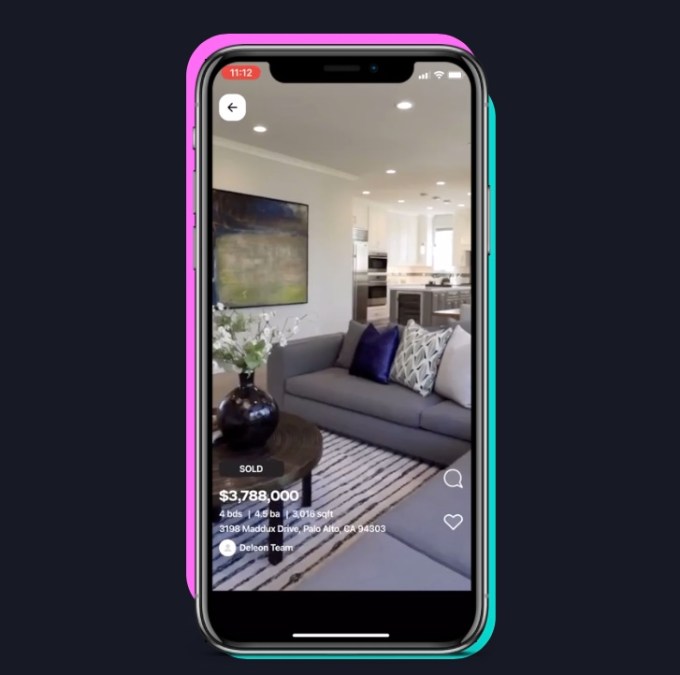

Playhouse: Playing on the trend of browsing Zillow “for fun,” Playhouse is a mobile app for quickly perusing video listings of homes for sale. Co-founder Alex Perelman says the company’s most engaged users are watching 50+ videos on their first day alone.

Genuity: Genuity is building a SaaS platform that helps enterprises manage their IT and source business software. It’s a space with plenty of entrenched players, but Genuity is hoping to win over customers with an inexpensive offering that helps IT professionals get done what they need to.

InstaKin: Helps immigrants in the U.S. manage projects and tasks back in their home countries, connecting them with verified vendors from afar and handling payments securely.

Odiggo: The services platform helps Middle East/North Africa (MENA) consumers get car services within minutes. Some cities demand car owners have brand new tires or even limit dustiness of the vehicles, so Odiggo is in the business of completing those requests. In July, the company had $500,000 in GMV and $44,000 in revenue.

Covie: If you have an app or service that needs to check or track a customer’s insurance coverage to work, Covie wants to make it easy to do that right in the app. Most rental and car insurance policies are supported and they’re signing up providers and aggregators to simplify this process for everyone.

ShipBlu: Promising “Amazon level logistics” for companies in MENA, ShipBlu does 24-hour delivery with live tracking. Co-founder Ali Nasser says that 47 merchants have signed on so far.

Dime: Dime is building an NFT marketplace that’s more accessible to users looking to buy digital collectibles with USD not crypto. Crypto wallets are notoriously complicated, and Dime is hoping that they can combine the benefits of the blockchain with easier user onboarding.

Nomod: Helps international merchants process payments on their phone, minus the need for Square-style hardware.

Verano Health: Flagged as the nonprofit of the batch, Verano Health wants to help Medicaid patients access telehealth services. The startup uses SMS and digital coaching to help diabetic, underserved patients navigate their condition. Verano Health is raising $2 million in donations and, per the founder, expects to be profitable by 2023.

Pluggy: Pluggy is Plaid for Brazil: a simple way for developers to access users’ financial data, like bank accounts and investments, within an app or service. They’re totally focused on Brazil and already cover 90% of the banks there. With thousands of users already signed up they seem to be well on their way.

Algofi: A lending market built on the Algorand blockchain. Algofi’s Owen Colegrove says they hit over 2,000 users a week after launching.

Scispot.io: Scispot is building a project management platform for bio companies leveraging automation to help track projects, samples and inventory while collaborating with team members.

Muse: A no-code editor for building immersive 3D websites, charging $12 per site per month. Co-founder Benjamin Ha says users have built 300+ websites so far.

FloatPays: Payday lending can be one way to bring financial inclusion and access to underserved communities, and FloatPays wants to make it on-demand. The startup is building a wage access service built for African businesses and has landed 34 customers so far. It has also engaged with financial institutions, landing distribution partnerships with two African banks.

Zeit Medical: Zeit has created a wearable headband that warns users and caregivers of early signs of stroke while sleeping, preventing damage to the brain from progressing too far before treatment. I wrote them up here!

Kurios: Online courses for professionals in Latin America. Co-founder Carlos Lau says the company is currently seeing $60,000 revenue and 25% growth per month, with 90% of users completing their courses.

Buoyant Aero: Buoyant is using electric blimps to move air freight over medium-range distances, which the startup says is 4x more efficient than using small aircraft. The company has built four airships and is aiming to tackle the $6 billion rural U.S. middle-mile freight market. We wrote about them here!

Infiuss Health: Many clinical trials lack African participants, resulting in side effects/shortcomings that go undiscovered for far too long. Infiuss is a platform meant to allow U.S. and EU pharma companies to more efficiently run clinical trials in Africa.

KaiPod Learning: The Boston-based startup wants to be the go-to place for online learners and learning pod families to get in-person interactions into their curriculum. KaiPod learning grows through launching centers, reminiscent of Kumon and WeWork, that welcome children to swing by during the school day — either for a refresh in existing curriculum, or for some social activities with peers. Read more about Kaipod here.

SolarMente: SolarMente is a marketplace for solar rooftops focusing on Europe. They’re bringing in $120,000/month already for installations and financing, at about $10,000 per home. Spain is their first market because electricity costs are high — so SolarMente takes over the whole process, soup to nuts, and hopes to do so for millions more.

idemeum: Helps small/medium-sized businesses manage employee access to their ever-growing collection of SaaS apps, aiming to replace manual password-sharing with biometrics.

Revolve Surgical: Revolve is building surgical robots for operating rooms, aiming to create a device that’s much smaller (and cheaper!) than the incumbent solution.

Hotswap: Helps you onboard companies when they’re looking to switch from another vendor, breaking vendor lock-in and automating the import of complex data from one platform to another.

Image Credits: Luminate / Wild Island Pictures

Luminate Medical: Hair loss from chemotherapy is one of the medical world’s most recognizable side effects, and Luminate may have a solution: a compression therapy helmet that prevents the drug cocktail from reaching and damaging the hair follicles. It’s on its way to clinical trials and FDA approval — you can read more about the company’s tech here.

Filta: Face filters are hugely popular on Snapchat and other apps, and Filta aims to monetize them with an NFT market for limited edition filters that creators can sell to their fans. Look for them on the app store in November.

Coinrule: Helps individual/retail investors automate their crypto trading. The team says it’s currently seeing $80,000 monthly recurring revenue, with an average of 30% MoM growth over the last 12 months.

Customily: A design tool for helping online stores sell more personalized products. Companies can use Customily to design, sell and print customizable products, letting users take control with their embeddable tool.

Union54: An API to help companies (think banks, fintechs and large retailers) issue debit cards in Africa.

HeyCharge: Patent-pending technology for customer-friendly indoor EV charging. HeyCharge wants to bring low-cost EV charging to offices and apartment buildings. Two unique bits of the startup’s tech: It claims to work offline and underground, a rarity for the industry.

Clarity: Clarity is a workspace for teams that focuses on simplicity without losing too much in capability. With document collaboration, project management and task tracking built in, it’s meant to reduce your tab load, organize and centralize.

QOA: Cocoa-free chocolate developed through precision fermentation, with the goal of making chocolate “10x more sustainable and 20% cheaper.”

Careerist: Edtech meets SaaS in Careerist’s job placement learning platform. The startup trains job seekers through live and self-paced training taught by third-party tutors. The adaptive learning software is meant to help candidates prep for tech interviews. Once a candidate is well equipped, Careerists uses automation to help them apply for jobs. The startup doesn’t require tuition until candidates are placed.

Abstra: A Figma-inspired no-code app builder meant for designers. Bruno Vieira Costa says the product, currently in beta, is seeing $2,000 in monthly recurring revenue with seven customers.

2Cents: 2Cents is building an Ethereum protocol for communities, basically bringing web3 dynamics to users wanting to create a Reddit-like community, turning active members into “owners” of the community.

Lago: Growth teams need to segment and sync customer data across lots of channels, like marketing, sales and more, but the existing tools for this are expensive, require engineering work and are generally enterprise-oriented. Lago does it no-code style so smaller teams can onboard quickly and simply with no extra hires or second mortgages.

Matrubials Inc.: Another startup in the health tech space, Matrubials is creating milk-derived therapeutics to target bacterial infections. It’s starting with a product that targets recurrent bacterial vaginosis with an antimicrobial peptide that attacks the bad bacteria, but not the healthy biome it is attacking. The company plans to target other infections in the future.

Encuadrado: Encuadrado is a payments and booking provider that helps entrepreneurs in the service industry in Latin America manage customer onboarding and logistics while minimizing unnecessary administrative work.

Reframe: An app that aims to use psych concepts to help users drink less and provides them with a private/anonymous support community. Co-founder Vedant Pradeep says 80% of their users see a “significant reduction” in alcohol consumption within two months.

Hypercore: Helps lenders automate workflows and access real-time analytics through software. The team estimates that more than 90% of private lenders use Excel or antiquated systems to manage processes, so Hypercore would be a welcome, albeit late, addition amid the broader landscape of digitization. The startup has $3,500 in monthly recurring revenue and launched officially during the accelerator.

Safer Management: Safer Management helps public schools track attendance, an important metric for funding — and, of course, education. It’s a modern system of QR codes and facial recognition that reliably tracks who’s in class. They’re already in 75 schools and two colleges and pulling in $621,000 yearly.

Fluke: Google Fi is a MVNO, or mobile virtual network operator here in the United States. Fluke is building something similar, but for Brazil. The company says that Brazilian mobile carriers offer poor service, which they want to take on. The startup also won our heart for talking about its CAC and LTV results, both of which it claims are better than its in-market competition.

Pipekit: Pipekit is looking to help enterprise customers scale their data pipelines quickly, with a control panel for Argo workflows, allowing for speedy implementation.

Zen: Webcam-based posture correction software that alerts the user when they’re slouching. Meant to be offered as a perk to employees to reduce a company’s workers’ comp costs.

Meticulous: A tool to catch bugs in web applications. The startup reduces the need for manual/integration testing, freeing up developer time to work on more complicated issues. The startup has two pilots and one secured deal for its software.

Fingo Africa: Fingo Africa has a simple proposition: a pan-African neobank backed by the biggest traditional bank on the continent. It plans to cut fees from 10% of payments to 1% and make money anyway with volume. Sounds like it’s going to work to me.

SliceQ: Sure, some startups are building delivery robots and ordering systems that include new tech. But SliceQ wants to take a very old tech and refurbish it for the modern world. The service lets restaurants take orders over the phone using automation technology. The startup claims that its service helps its customers boost sales by 10%, and it helped process $200,000 in GMV last month.

Carbonfact: The sustainability startup is creating a carbon footprint database for consumer products, helping certify companies that have low-carbon-output product offerings and providing a tool for comparing a company’s sustainability efforts to industry averages. In the past 10 weeks, the company has onboarded 20 brands to the platform.

Cloudthread: Analytics meant to help engineers build for the cloud more cost-efficiently, and incorporate cost into engineering decision-making.

Pabio: This startup wants to make furnishing your apartment a light lift, metaphorically speaking. For a monthly subscription, Pabio creates a 3D scan of your apartment, has it professionally furnished by an interior designer, and then offers rent-to-own furniture that matches your aesthetic. The service is currently available in Switzerland but is soon expanding to other countries.

Plai: Plai is an ad tool for microbusinesses that lets people like Etsy sellers and YouTubers launch targeted ads from their phones in seconds. It’s a simple, low-risk way to get your brand out there, and with more people than ever working for themselves, that’s an attractive proposition.

ContraForce: ContraForce wants to bring security alerts and other related incidents into a single place. The company claims five customers and $75,000 in current ARR. Security breaches plague businesses of all sizes, with ContraForce pitching itself as more of a product for the SMB market.

Inspector Cloud: Inspector Cloud is building computer vision software that helps consumer brands track how their products are being displayed at physical retailers. The analytics software help brands audit their network and analyze the effectiveness of stores selling their products.

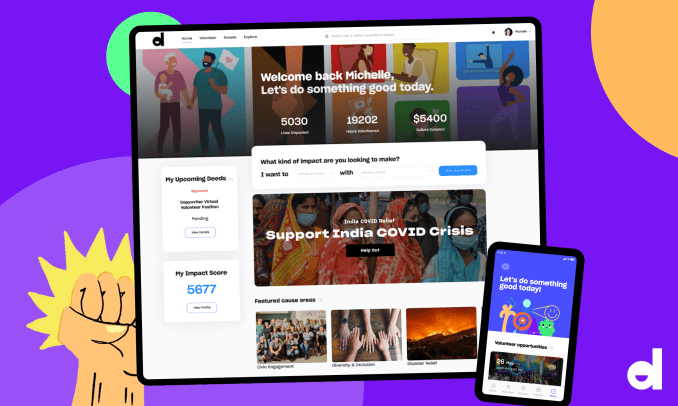

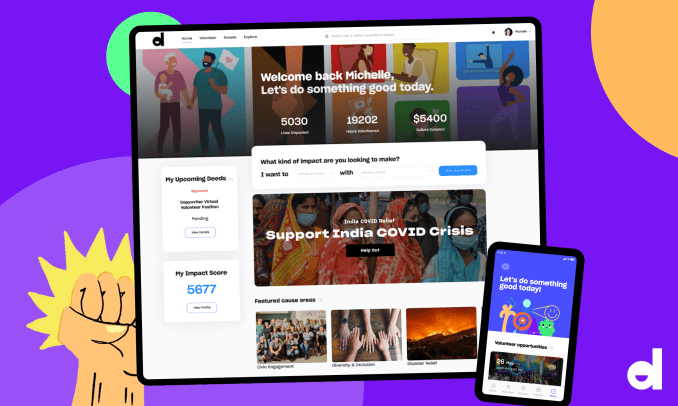

Image Credits: Deed

Deed: A modern, super pretty take on the backend powering your employee’s charity/donation/volunteering system. Handles donation matching, volunteer hours, etc. Already working with companies like Airbnb, Stripe, Doordash and Adidas. We wrote about Deed here.

Genei: Too long, didn’t read? Good, meet Genei. This startup has created a way for content writers to get cliff notes on background reading to boost productivity, and speed up the time it takes to comprehend a complicated topic. Automatic summarization may be the use case that robots and writing can actually pull off, versus the controversial world of article generation. It’s starting by selling to freelance writers and has $9,000 in monthly recurring revenue.

Orderli: It’s Square, but for Europe! Easy to explain, probably super hard to build. Orderli works as a point-of-sale system and is already in 57 bars and pubs and pulling in over $600,000 in receipts.

Portão 3: The market for products to make corporate travel and expenses is never-ending, as most existing products are awful. Portão 3 (Gate 3) wants to make better travel and expense software for the Latin American market. The company is notable in that expense management and travel management are sometimes distinct products. Brex is not Travelocity, for example. But by bringing both together the company could offer a more cohesive solution than other products.

Pactima: Pactima is building an e-signature platform that reaches the use cases that DocuSign can’t, letting users tap real-time video-signing when a witness is required as well as in-person digital signing.

Shopscribe: Subscriptions for local shops! Think coffee shops pre-selling a weekly coffee at a discount, or nail salons selling regular manicures. Shopscribe takes a 10% cut of each subscription.

Preki: A way to help LatAm businesses create cheap, easy-to-use websites. In July, Preki hit $4,000 in GMV, and its Shopify-competitive software currently services 208 merchants.

Aleph Solutions: A tool for offline businesses to bring their services online. Aleph Solutions is building an online marketplace for resellers, which it monetizes through a SaaS and transaction fee whenever a sale occurs. It revealed 18% month-over-month growth, with $115,000 monthly recurring revenue.

Datlo: Datlo is building a data analysis service for Latin American companies. It wants to help customers’ sales and marketing teams import large datasets, sort them and visualize the results. So far it has landed two large Brazilian banks as customers and reached $20,000 MRR. Our question is how the product is tuned for the Latin American market as opposed to the larger world. Regardless, it sounds cool.

TrackChain: TrackChain is an online freight marketplace for Latin America that’s looking to streamline logistics for shippers and carriers moving freight through the region. The company currently has 600 carrier companies onboard.

Chari: Next-day item procurement for small retailers in North Africa. The company says it’s seeing a monthly GMV of $1.4 million after launching 18 months ago.

Palenca: Palenca lets employers in LatAm share and check employment records, do background checks and identity verification, then offer financial services based on that data. You know they’re going to be a success because, as the founder noted, they’re literally the only option for this! Hopefully this kind of accountability benefits the workers as well as the employers.

Flow Club: A virtual coworking space modeled on group fitness classes and social clubs intended to motivate people to work in sprints. Join for a few hours when you need that push to stop procrastinating — and who doesn’t every once in a while in this day and age?

Onfolk: The success of Gusto in the United States in terms of both securing capital and customers is drawing startups into creating similar companies targeted for their home markets. Onfolk is building a Gusto-like service for Europe. Given the number of companies in the larger EU, it won’t lack for TAM. And since it intends to monetize through B2B SaaS, investors shouldn’t struggle to understand how it intends to scale.

Pide Directo: The startup is building a white-labeled solution for local businesses in Latin America to sell and deliver to their customers, teaming an online storefront, marketing service and delivery network.

Codex: Deeper collaboration for programmers, built especially for remote/async teams. Lets you, for example, highlight code in your editor, determine who wrote it and request information without switching screens.

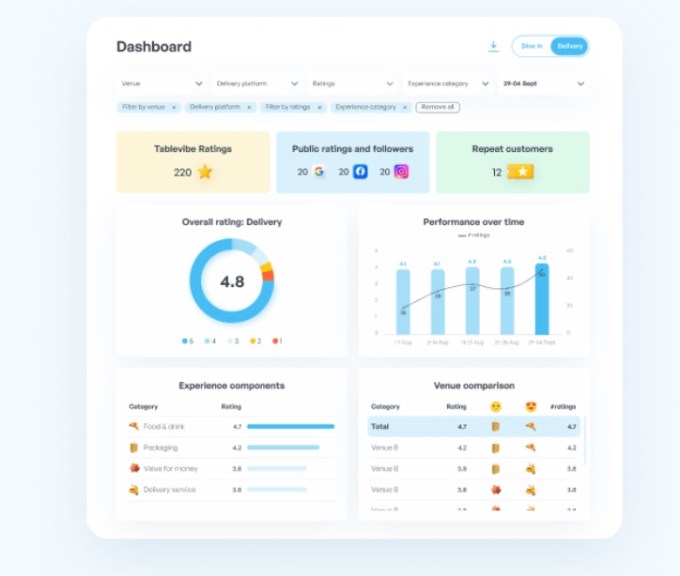

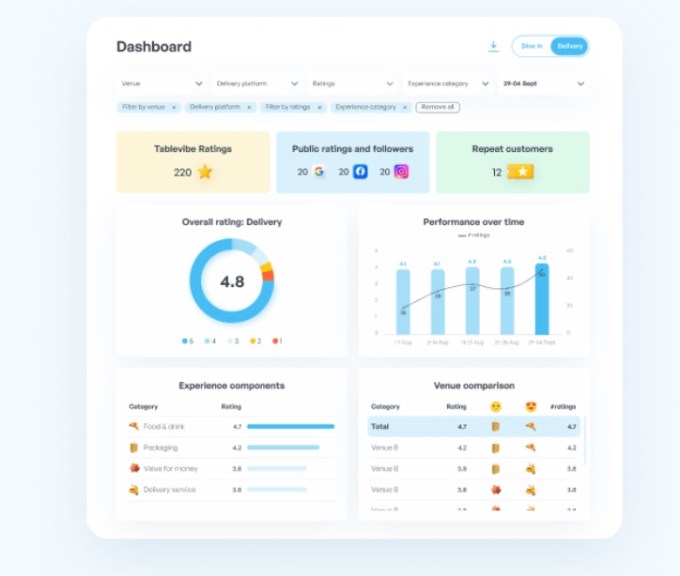

Tablevibe: Customer loyalty is an important objective for restaurants, so Tablevibe wants to find ways to better track and engage folks while they’re chowing down. The startup helps capture feedback through QR-code-based surveys, exchanging loyalty incentives for insights. So far, the early-stage startup has landed 100 paying customers, tracked 25,000 experiences and positioned itself ahead of the industry’s digitization beyond Toast.

Lernit: Lernit is a corporate learning platform aimed at the LatAm market. Companies can train their employees and track their performance gains, simply and with plenty of built-in features.

Café: The remote work boom is now so entrenched that startups are being built to make remote work better. Cafe is one of them. The company wants to help remote and hybrid workers figure out where to work from each day. Apparently the answer is not, well, in your home office. The company has $8,000 in MRR and sees a future where offices are optional and not mandatory.

Búho Contable: The startup is building a TurboTax for Mexico, building out a tech-enabled tax filing and accounting firm geared toward helping small businesses in the country navigate the process.

Payflow: A mobile app that allows employees in Spain and Latin America to “get paid whenever they want,” rather than waiting for their paycheck to come in monthly bursts. Free for employees, it’s sold to companies as a perk. The company says there are currently 40,000 employees on the platform.

Argus: An compliance tool for employees with investment restrictions. Personal trading can be complicated for employees at banks, law firms and crypto exchanges due to potential conflicts of interests and various other restrictions. Eventually, Argus wants to become an investment adviser for these employees — right now, it’s just starting by helping them not screw up.

Cabal: Cabal is a private workspace for founders, investors and advisers to update one another and organize things like equity distributions. Sure, you could do it in Slack or something, but this one is built with the startup and stakeholder crew in mind. Plus it’s cool to be able to say “join our Cabal.”

Hedgehog: Back to the robo-adviser theme, Hedgehog is an SEC-approved service that helps consumers buy crypto products. It claims to offer trades at the best possible price, and $70 million in AUM. Personalized crypto advice is a neat idea, given that mostly what we’re told on Twitter is either “hodl” or “go fuck yourself.” If Hedgehog can scale its AUM, Coinbase might swoop in with its checkbook.

Examedi: Examedi is a home healthcare marketplace for Latin America helping consumers match with healthcare providers and take at-home medical exams on their own schedule. The company grew 160% in August.

Potion: AI to help R&D teams (starting with beauty companies) formulate their products, replacing processes that generally require lengthy trial-and-error with simulation.

Trii: Launched six months ago, Trii is a U.S. and local stock investment platform for retail investors in LatAm. Across its 30,000 users, the startup has processed more than $60,000 in transactions and has $10 million in assets under management. Trii looks to circumvent local brokers, who have high fees and required minimums, with $2 per trade fee and no required minimum.

Synder: E-commerce companies need to do accounting too, but as we’ve seen suggested by other companies, it’s not particularly easy or simple. Synder aims to automate as much as possible, looping in all the major sales platforms and doing the bean-counting magic every company needs to do to make sure they’re actually making money. With 3,900 customers already, it seems plenty of folks were waiting for something like this.

OneSchema: CSV imports can be a bit of a mess, and cleaning up data is a huge pain in the backside. OneSchema wants to hammer on both issues at the same time with a spreadsheet UI that can correct CSV data, in theory allowing customers to upload data with fewer errors. Excel holds up much of the modern world, and lots of folks stuck making Microsoft’s spreadsheet tool work for their needs could use some help. Let’s see if OneSchema can help.

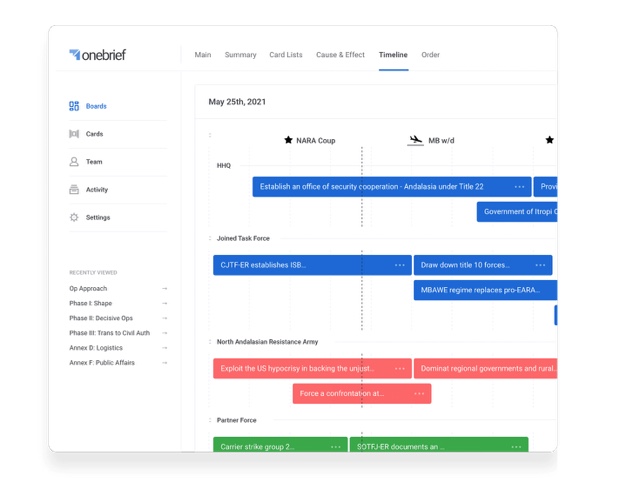

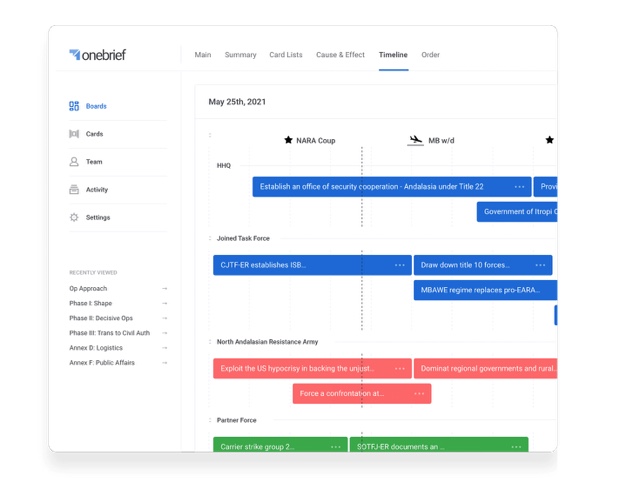

Onebrief: Talk about purpose built. Onebrief is a tool built to help military headquarters with their joint planning needs, while keeping things presentation-ready in order to boot out PowerPoint. The company says it recently signed a $350,000 deal with a four-star military HQ.

CostCertified: CostCertified is building a marketplace for players in the residential construction world, allowing suppliers, contractors and consumers to connect inside a single platform, ensuring that estimates stay accurate and minimizing surprises.

Legion Health: Helps psychiatrists and therapists sell their time to telehealth companies by the hour.

Ahazou: A SaaS-platform for local businesses in LatAm bring businesses online through services such as payment processing, digital marketing and reviews. It is the latest startup aimed at helping local shops, from nail salons to painters, prepare for a post-COVID landscape. Over 16,000 companies pay for Ahazou’s software, resulting in $1.2 million in annual recurring revenue. Still, it’s just a drop in the bucket for what the team estimates will be a $4 billion market of local business in LatAm.

Dots: If you’re a seller or service provider, the platform you sell on may very well not want to pay you in the way you want to be paid, whether that’s old-school ACH or instant transfer via Venmo or CashApp. Dots provides a single API to marketplaces that lets them pay out via any of those methods and more, simplifying the finances of everyone involved.

PaletteHQ: If you haven’t worked in a sales team, you might not be aware of how the commission process works. It varies company to company, and can change based on evolving corporate goals and product releases. So managing a commission setup that sales folks can understand — and therefore find motivating — is complex. Palette wants to shake up the issue with software and has reached $10,000 in MRR thus far. Twist: Sales people selling sales-focused software to sales team leaders? Surely that’s an advantageous market perch.

Inai: A no-code platform for handling payments globally. It hooks into your payment providers (like Stripe, Paypal), fraud tools (like Sift) and tax tools and wraps them all up in a easy to configure dashboard.

Artillery: Pitched as a “modern load testing” platform, Artillery hammers your product with traffic (millions of requests per second originating across 13+ different regions) so there are no surprises later.

Breadcrumbs.io: Analyzes customer and prospect data to help companies identify hidden revenue opportunities. The no-code scoring engine has attracted $185,000 in annual recurring revenue to help startups make sure they don’t leave any lucrative breadcrumbs behind. Non-obvious revenue may just pique investor interest, especially when it comes to serving their portfolio companies.

Protex AI: Protex AI is a computer vision company that identifies dangers in industrial workplaces before they become a problem. Maybe that’s workers too close to dangerous processes, or a machine starting to fail or something catastrophic — catching them even a second or two earlier might avoid disaster. Their first install caught 60% more safety violations than human monitoring, an increase that might alone justify the company’s $25,000 per site fee.

ContainIQ: An easy to install platform for monitoring Kubernetes events and metrics over time, with hooks like Slack support for alerting your team when things break.

Epsilon3, Inc.: Built by a team with hundreds of rocket launches under their belt, Epsilon3 is an “operating system” for spacecraft launches (and other complex operations) — effectively taking the ridiculously complicated but too often still paper-based procedures/workflows and making them digital.

Hotglue: A developer tool designed to help create native SaaS integrations with data sources in minutes, aiming to help users sidestep jumping through development and maintenance hoops.