Crypto was big at YC this batch.

Y Combinator Demo Days returned yet again with another ballooning heap of startups. In the old days, a gaggle of TechCrunch reporters would go to the Demo Day in person, write up the presentations of each startup and hobnob with VCs during the breaks, but in a post-pandemic bloat, YC has gotten just so massive that one comprehensive list of startups is neither feasible nor particularly useful to readers. That said, this was a massive year for crypto and I wanted to make sure that we profiled each and every crypto startup that publicly launched at Demo Days this batch.

The list of 25 companies unsurprisingly spans NFTs, DeFi, web3 services and crypto investing.

A couple of notes on these descriptions… These are listed in the seemingly random order in which they appeared on the YC Demo Days site. The “What it says it does:” sections are also taken from that site, while the “Founders:” section is largely based on info from the LinkedIn profiles of the co-founders of each startup. I have not personally fact-checked any of the information that was self-reported by the founders themselves. The “Quick thoughts:” section is made up entirely of my own insightful thoughts, though I also cannot guarantee that they are always all that insightful.

Now, onto the startups… But wait! While I have you, please do me a favor and subscribe to TechCrunch’s new crypto-focused podcast and newsletter Chain Reaction which is launching in April — hosted by myself and my colleague Anita Ramaswamy.

Okay, now, onto the startups!!

SimpleHash

What it says it does: “SimpleHash allows web3 developers to query all NFT data from a single API. We index multiple blockchains, take care of edge cases, provide a rapid media CDN, and can be integrated in a few lines of code.”

Founders: Alex Kilkka previously co-founded NFT social network Showtime and Olly Wilson has been an EIR at Portage Ventures.

Quick thoughts: The NFT market has made huge strides already on Ethereum, but it’s no secret that any future mainstream embrace of NFTs will rely on Layer 2 blockchains lowering transaction costs. Where this creates opportunities for startups, it also introduces cross-chain headaches for them, something SimpleHash is looking to streamline.

NFTScoring

What it says it does: “NFTScoring is the place for you to discover, analyze and trade NFTs. We give you the superpowers to understand the NFT market in any given moment, make the best decisions, and take faster actions.”

Founders: David Mokoš and Adam Zvada previously co-founded AI lab Cognitic and hyperlocal delivery platform GoDeliver together.

Quick thoughts: NFTScoring is trying to build a better dashboard for NFT traders which accounts for some of the unique attributes that make some NFTs more valuable than others, all while helping users find trending projects early. A big emphasis appears to be tracking which projects NFT whales are buying into through tracking a network of wallets. The startup has premium tier pricing which users need to pay for with Eth.

Remi Labs

What it says it does: “Launching an NFT collection can seem tantalizing for brands, however, when executed poorly can create long-lasting negative implications. We take the cringe out of NFTs.”

Founders: Brant Choate and Dan Conger both previously worked in senior roles at enterprise messaging startup Podium.

Quick thoughts: Basically as soon as NFTs took off, brands looked how to get involved and saw a pretty confusing space with a lot of consumer skepticism tied up in it. Soon after, a lot of white-label NFT services took off aiming to give them a better path towards launching NFT projects. Remi Labs is eyeing this opportunity with a specific focus on NFT collections early-on.

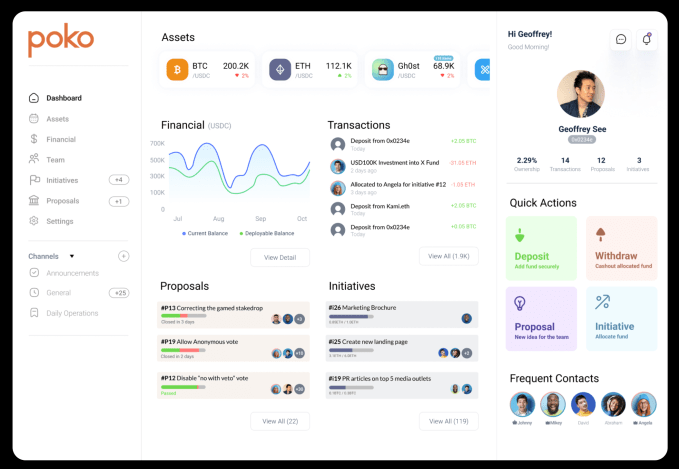

Image Credits: Poko

Poko

What it says it does: “We are building Slack for Web3. We aim to replace LLCs with DAOs in emerging market cross border collaborations. We will take costly multi-step months-long company registration and setups down to $50 a month and with the ease of opening a Slack channel.”

Founders: Van Tran previously led strategy in the SEA region for Netflix, Geoffrey See was an exec at identity startup Trusting Social and Sean Ang founded education org Success Alliance Enrichment.

Quick thoughts: DAOs are hot, but the tooling behind them is still catching up with the hype. Poko is leaning into the idea of using DAOs as LLCs which has some legal blurriness stateside but less so in plenty of other geographies including Singapore (as far as I know) where the startup is based.

GoSats

What it says it does: “GoSats is a bitcoin rewards app. We help people accumulate free bitcoin as cashbacks and rewards every time they shop in India.”

Founders: Roshni Aslam was previously a research analyst at consulting firm ONEX AE, Mohammed Roshan was the CTO for blockchain startup ThroughBit.

Quick thoughts: Crypto credit card rewards are a pretty well-worn path at this point. Though India’s government has played hardball with crypto thus far, plenty of entrepreneurs see the market as one where the industry has outsized opportunities.

Cashmere

What it says it does: “Cashmere is a crypto wallet for web3 startups to manage their digital assets on Solana. Instead of running their business from one person’s wallet, startups can use our wallet to collaboratively manage their funds.”

Founders: Shashank Khanna previously was a senior engineer at SoFi, Rebecca Lee was a deployed engineer at Retool and Charlotte McGinn was a software engineer at Tesla.

Quick thoughts: Consumer crypto wallets have been big business over the past year, but the tech to help startups, projects and DAOs manage funds securely with enterprise-grade multi-signature wallets has had less action. Solana has courted plenty of developer attention over the past year and they are. aiming to replicate some of Ethereum’s tooling while leveraging Solana’s advantages to make improvements.

Chaingrep

What it says it does: “Chaingrep is a search engine for on-chain interactions and digital assets. You can think of it as a new kind of block explorer. We think that current block explorers like Etherscan are too complicated to use for regular users, and that abstracting a lot of their functionalities and filtering out all the noise can dramatically improve the experience of finding on-chain information.”

Founders: Rosco Kalis previously was an engineer at crypto startup Truffle, Merwane Drai has no LinkedIn profile but says he’s working on hacking his way out of the matrix.

Quick thoughts: The transparency offered my blockchains is only as good as the platforms that make interpreting that data simple and readable, something that will become more important as more non-technical users find their way to web3 platforms.

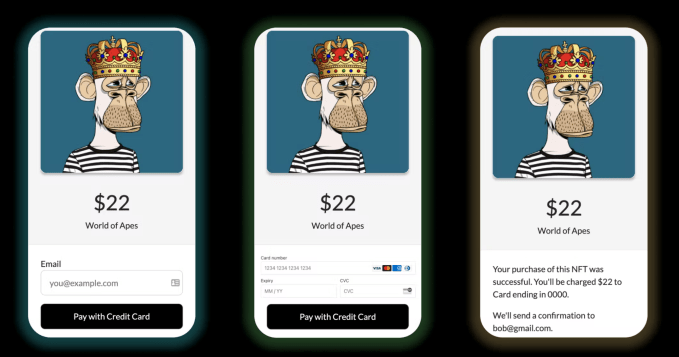

Image Credits: Winter

Winter

What it says it does: “Winter offers an embeddable widget to help your consumers buy an NFT with a credit card or bank account! We also help custody & manage a user’s NFT if they don’t have a wallet.”

Founders: Michael Luo was previously a product manager at Facebook, Laila Chima was a software engineer at Stripe.

Quick thoughts: For anyone who has navigated the process of buying an NFT, the headaches associated with buying crypto on a centralized exchange, creating a wallet and transferring the crypto to that wallet to make a purchase are often the most time-consuming parts of the process. It’s unsurprising that startups are trying to abstract this away with credit card purchases, which will likely appeal to web2 platforms that are trying to find an opportunity in NFTs.

Decent

What it says it does: “Decent enables musicians to monetize their work directly through their fans, aligning artist & fan incentives to reinvent funding, IP protection, and discovery. We do this through a marketplace and infrastructure that enables musicians to issue NFTs collateralized by their royalties.”

Founders: Will Collier was previously an analyst at Accenture, Charlie Durbin was an analyst at Vox Media, Will Kantaros is studying Applied Math and Econ at Brown, Alexander Carlson is a music producer.

Quick thoughts: NFTs have largely found their fit in the art world, but a handful of startups have been trying to find opportunities in other facets of media like music. Decent’s sell seems to be creating NFT incentive structures for new fans to build up buzz around musicians over time that’s more closely tied to the success of the songs themselves.

Yatima

What it says it does: “Yatima is a Substrate blockchain which uses on-chain formal verification and zero-knowledge proofs to radically improve the safety and scalability of smart contracts, and other deterministic computations.”

Founders: John Burnham was previously CEO of Sunshine Cybernetics, Samuel Burnham recently graduated with a CS degree from , Gabriel Aquino Barreto has worked as an Ethereum software developer.

Quick thoughts: This is one of the more technical startups listed thus far and some of the details are lost on me, but Yatima is building a crypto programming language based around emerging technologies like zero-knowledge proofs, which use complex math to cryptographically verify batches of transactions and are generally seen as a key element of the future of more scalable, trustless blockchains.

Image Credits: CypherD

CypherD Wallet

What it says it does: “Existing Crypto Wallets are too geeky for mainstream users. We are building a multi-chain crypto wallet simplifying user experience for the mainstream users along with a crypto card.”

Founders: Kuberan Marimuthu was previously a senior engineering manager at Coinbase, Muthukrishnan Ramabadran was a senior software engineer at Lyft, Dheeban S.G. was a senior engineer at blockchain startup Magic.

Quick thoughts: There are some major unknowns around what the future of consumer web3 look like, but most investors are assuming that wallet apps will play a pretty central role in that future, giving users a central place to host their coins and NFTs. CypherD is looking to make wallets a hub for USD assets as well, giving users a MasterCard debit card that they can use after converting crypto into USD inside the wallet.

Courtyard

What it says it does: “Courtyard stores physical collectibles (trading cards, sneakers, watches, etc.) in secured vaults, creates a 3D representation of the asset and mints it as an NFT on the blockchain. We’ve partnered with one of the largest security companies in the world to store collectibles.”

Founders: Paulin Andurand was previously a senior software engineer at Apple, Nicolas le Jeune was previously a manager at YouTube.

Quick thoughts: NFTs are great at creating liquid markets for digital assets, but there’s been a lot of chatter about using them to make transacting physical collectibles easier. Vertical-specific marketplaces have already had some success aiming to do this, though there have also been legal challenges associated with selling digital assets that use the likenesses of physical product as a token.

Payourse

What it says it does: “We build the tools and infrastructure that make it easier, faster and cheaper for anyone in Africa easy, fast and cheap access to crypto and web3.”

Founders: Bashir Aminu was previously head of Africa for Binance P2P, Hakeem Adeyemi Orewole was previously a software engineer at Andela, John Anisere previously was a senior software engineer at Intersection Ventures.

Quick thoughts: Crypto advocates are quick to highlight how blockchain-based payments can do wonders for unbanked users in developing countries, but precious little venture funding seems to have been given to teams aiming to do just that.

Argo

What it says it does: “Argo is on a mission to empower Film and TV makers worldwide. It’s the easiest way to upload and monetize your content. Argo provides the technology and the ecosystem for the Filmmakers to monetize their film and tv work through advertising, subscription and NFT sales.”

Founders: Arcadiy Golubovich previously led entertainment production company Primeridian.

Quick thoughts: Argo seems to be a media startup focused on short films first and foremost, offering a platform for filmmakers to showcase their work while also tapping NFT sales as a way of helping them monetize their work and build buzz.

Finnt

What it says it does: “Finnt is the first DeFi app for families. We provide multi-user, high yield saving accounts, which make it easy to save with crypto for your children or family members.”

Founders: Anji Ismail led product at Welcome, Faozi El Yagoubi was previously director of engineering at Ovavi

Quick thoughts: DeFi for families is an awfully specific pitch, which seems mainly focused on allowing users to link sub-accounts to a central investment account. High-profile exploits of DeFi protocols are undoubtedly going to leave some families skeptical of putting their nest egg here, but much higher yield rates are likely going to make it a risk some are happy to take.

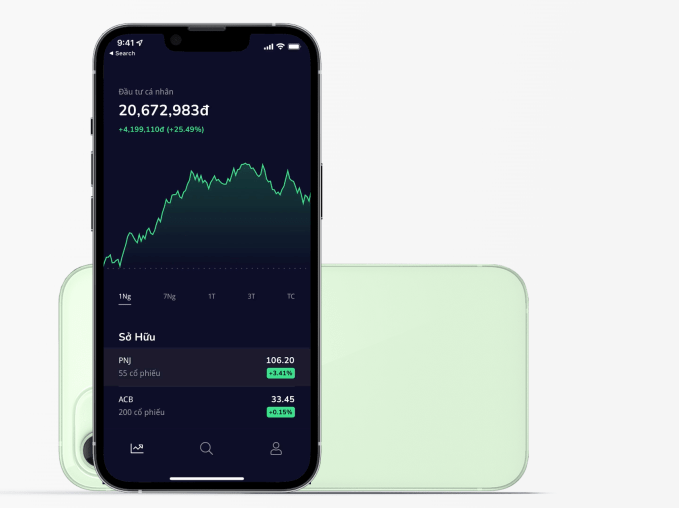

Image Credits: Tradezi

Tradezi

What it says it does: “Tradezi is the Robinhood for Southeast Asia. We aim to help everyone invest in stocks, crypto, and other alternative assets all in one place.”

Founders: Phi Dang and Jasmine Huynh were both previously senior software engineers at Google.

Quick thoughts: Robinhood has obviously done a lot to expose American retail traders to crypto by showcasing the coins alongside publicly traded stocks, this is a model Tradezi seems to be interested in tackling in SEA.

Botin

What it says it does: “Botin a mobile app where people in Latin America can invest in US Stocks, Crypto and more.”

Founders: Robert Baron was previously a developer at BitGo, James Jara was previously a software engineer at Avantica.

Quick thoughts: The Costa Rica startup is also taking the Robinhood approach towards stock and crypto to Latin American users and hoping to find a broader audience for retail trading.

earnJarvis

What it says it does: “earnJARVIS is a crypto investment platform that helps retail investors (i.e, you) and businesses intelligently invest across the crypto-economy.”

Founders: Atyab Bhatti was previously a manager at McKinsey, Kush Maheshwari was previously a software engineer at Rubrik.

Quick thoughts: Robo-advisors have been big business for entry retail investors, but crypto trading has largely been a DIY affair at the same levels. There’s likely going to be a crop of platforms popping up that promise to automate the process of diversifying across crypto assets while exposing users to elements of the DeFi world.

Magna

What it says it does: “We’re bring universally needed tools to crypto companies to help them manage their token distributions, tokenholder onboarding/offboarding, and other critical tools.”

Founders: Bruno Faviero previously was a product manager at Palantir, Arun Kirubarajan is a graduate researcher at Penn.

Quick thoughts: Cap tables have gotten hilariously convoluted in an era where crypto startups are granting both equity and tokens to investors and employees. The cleverly named Magna is looking to add some much-needed streamlining to managing token grants in the same way Carta rethought cap table management for web2 startups.

Soon

What it says it does: “With Soon you can invest without the stress of speculating. Our fully automated sweep account attaches to your bank and uses routine spending activity to signal market trades. By investing on a schedule and selling available gains when you spend, Soon automates investing from beginning to end.”

Founders: Chris Lovato was previously a DevOps engineer at Adobe, Aaron Bylund led corporate strategy at Nu Skin, Michael Shattuck was previously a senior software engineer at Pluralsight.

Quick thoughts: Just because new platforms are bringing users access to new asset classes doesn’t mean consumers all want to turn into part-time investors. Soon is building a platform that automatically invests idle money in a user’s bank account across crypto and more traditional assets.

LiquiFi

What it says it does: “LiquiFi (“Carta for crypto”) helps companies and DAOs automate their token vesting, management, and distribution to employees, investors, partners, and community members. Secure, audited smart contracts guarantee timely distribution of vesting tokens and save significant time and resources spent building your own solution.”

Founders: Robin Ji previously was a product lead at Eco, Oliver Tang was an engineering manager at Amazon.

Quick thoughts: It’s unsurprising that YC is backing a pair of startups approaching the same opportunity, token management is a clear web3 startup growing pain and YC has always been particularly successful in helping scale “startup-for-startup” products.

Arda

What it says it does: “A single API for fintechs to embed DeFi products on their platform. This allows them to acquire more customers, retain these customers and increase revenue & engagement, all in a custodial, secure, & compliant way.”

Founders: Pranay Shetty was an early employee at CloudKitchens, Ramkumar Venkataraman was the founding engineer of Moneyworld.

Quick thoughts: While trading stocks and crypto inside the same app has grown to be an expected feature of traditional trading apps, that same relationship hasn’t come to DeFi and traditional fintech services which live separate lives in separate apps and platforms.

OnScale

What it says it does: “OnScale is business bank for high-earning Creators that automates income budgeting, cash flow management, tax write offs and invoicing. We help creators automate financial tasks, save money and time.”

Founders: Tonjé Bakang Tonje is the founder of Afrostream, German Saprykin was a senior engineering manager at Grab.

Quick thoughts: While plenty of creator-focused web3 products have taken particular aim at NFT creators, OnScale is looking to help a broader swath of creators access traditional financial products while building in crypto rails to help users easily convert income into crypto inside the platform.

Blocknom

What it says it does: “We make crypto investing safe and easy for consumer and businesses through DeFi yielding. Our product is plain simple. People can deposit and withdraw in 3 clicks. Right after deposit, they might earn competitive interest with no hidden fees. The interest is obtained from DeFi protocols.”

Founders: Fransiskus Raymond was a sales manager at Gojek, Ghuniyu Fattah Rozaq was a developer at Ritase.

Quick thoughts: An awful lot has been said about DeFi yield farming which offers high percentage rates for depositing funds into investment pools. Sometimes these seemingly too-good-to-be-true rates have proven to be just that, but other times they highlight how much upside there is when users cut banks (and their associated protections) from the investing/saving process.

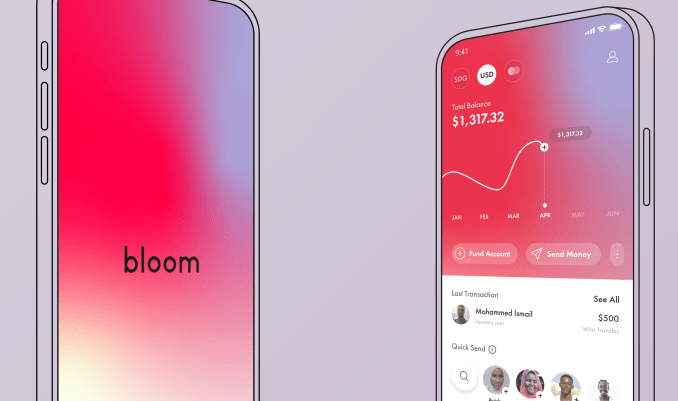

Image Credits: Bloom

Bloom

What it says it does: “Bloom offers students and young professionals in East Africa US Dollar banking. By saving in USD or digital dollars, and spending as they go in local currencies, they won’t be subject to inflation.”

Founders: Ahmed Ismail previously worked at Barclays, Khalid Keenan was an engineer at Finbourne, Youcef Oudjidane was a managing partner at Class 5 Global, Abdigani Diriye was a research manager at Amazon.

Quick thoughts: The Sudan startup is looking to tap stablecoins to help young professionals in East Africa avoid the hyperinflation common to many currencies in the region. There are clearly large opportunities in helping users in developing nations build wealth, but the risks associated with crypto means that these startups have a big burden of responsibility as well.

Take a look at some more of our Y Combinator Demo Day coverage.