In 2014, Angus McDonald, the former head of publisher partnerships at Yahoo (full disclosure: TechCrunch’s parent company), teamed up with ex-Googler Chris Bayley to found Cover Genius, an insurtech platform that prices and handles claims for virtually any line of insurance or warranty. After expanding the business to all 50 U.S. states and more than 60 countries, Cover Genius is gearing up for its next phase of growth, McDonald says, fueled by significant fresh capital.

Cover Genius today announced that it raised $70 million in a Series D round led by Dawn Capital with participation from Atlas Merchant Capital, GSquared and King River Capital. Bringing the 420-person company’s total raised to $165 million, McDonald tells TechCrunch that the proceeds will be put toward “assisting business growth” and further expanding Cover Genius’ insurance distribution services.

“We’ve co-created a wide range of protection solutions for partners across many verticals including several of the world’s largest airlines and travel companies, retailers and logistics players, mobility, auto and gig economy companies, banks, fintechs and proptechs and business-to-business software and event ticketing companies,” McDonald said in an email interview. “Having been bootstrapped in our early days, only raising $1 million from inception in 2014 to our Series B in 2018, we’ve been blessed to have significant partners to ensure a healthy and sustainable cash flow, while also carrying frugality in our DNA.”

McDonald and Bayley were motivated to launch Cover Genius after encountering insurance challenges with their previous joint venture, an international online travel agency. They found that traditional insurers were difficult to work with because every country the co-founders wanted to target required a separate insurance agreement with separate country leads.

In creating Cover Genius, McDonald and Bayley worked to gain licensing and approvals for embedded insurance in most major countries around the world. Unlike typical insurance plans, embedded insurance like Cover Genius’ is bundled with the purchase of a product or service, offered in real time or at the point of sale.

Ridesharing app Ola uses Cover Genius to offer insurance to both drivers and riders. Betterplace, an India-based human resources management software provider, taps Cover Genius’ technology to provide healthcare to contract workers. As for buy now, pay later provider Zip, Cover Genius built an AI-powered tool that classifies insurable items (e.g. a power drill) to recommend warranties to e-commerce customers.

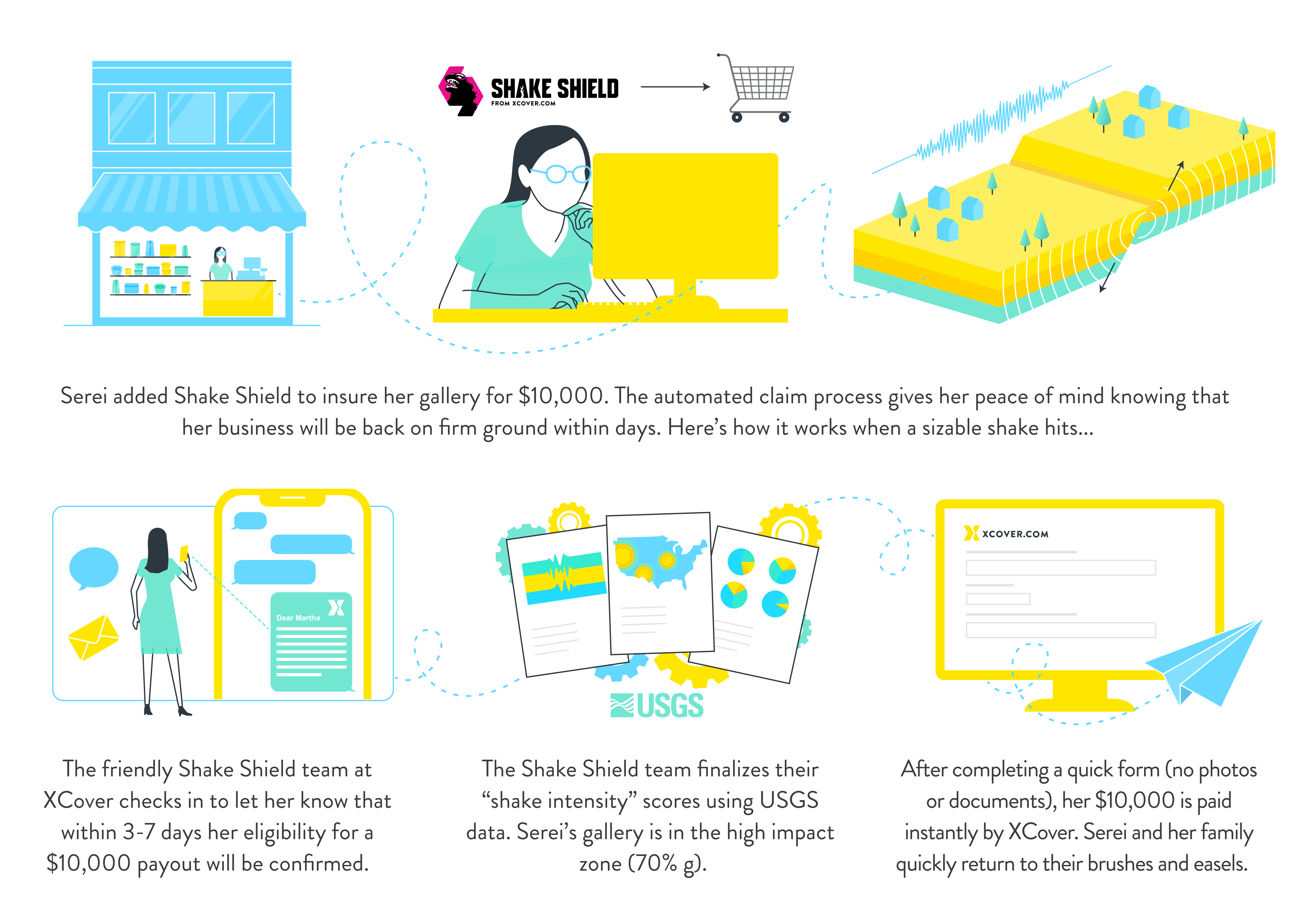

Among the products Cover Genius offers is Shake Shield, earthquake insurance backed by Swiss Re. Image Credits: Cover Genius

“We strongly believed in the embedded insurance model, which is the ability to protect customers at the point of sale or sign-up, and that there would be a major value shift away from direct-to-consumer and traditional insurers toward digital platforms partnering with insurtechs,” McDonald continued. “Customers gain access to tailored protection at the right time, removing the inconvenient need to take a second step to purchase protection. Partners achieve bottom-line growth and stickier customers and insurers benefit from a data-rich distribution channel.”

There’s no doubt that embedded insurance is the hot new thing in insurtech. Startups in the space, many founded within the past five years, raised close to $800 million in VC funding in 2021. And a recent report from Simon Torrance, an embedded finance and app strategies advisor, estimates that embedded insurance in property and casualty alone could account for over $700 billion in gross written premiums by 2030, or 25% of the total market worldwide.

New York-based Cover Genius has competition in insurance vendors like Extend and Bolttech. But it also has a robust client base, covering 10.5 million customers across merchant partners such as Intuit, Kayak, Booking Holdings, Priceline, Turkish Airlines, SeatGeek, Amazon, eBay and Wayfair. While Cover Genius was initially impacted by the pandemic — the company primarily offered travel insurance in 2020, when the industry took a hit — McDonald notes that it’s been able to branch into a range of new market segments over the past two years.

The branching out came through a combination of product launches and acquisitions. In July, Cover Genius made a strategic investment in India-based insurtech Ensuredit and bought Booking Protect, a ticket refund protection startup that brought SeatGeek onto the Cover Genius Platform. And in June, Cover Genius launched a “price-optimized” warranty offering for small- and medium-sized ecommerce businesses.

One hurdle on the path to expansion that Cover Genius will have to overcome is the general sentiment around insurance — which isn’t positive. A 2019 survey by the Geneva Association, a global association of insurance companies, found that more than half of people (53%) have had a bad insurance experience. In a separate report from IBM, less than half of customers said that they trust the insurance industry.

McDonald says that Cover Genius’ products speak for themselves.

“By delivering peace of mind and a high-quality customer experience, boosted by product relevance and seamlessness from the time of sale to claims, our partners get to enter new territory with their customers,” he said. “In the past, they’ve either had experience working with traditional insurers, who negatively impact the customer experience and invariably cause churn and backlash against their own brand, or they’ve tried to engage with traditional insurers and have given up because all the ‘heavy lift’ otherwise sits with them.”

Cover Genius lands $70M infusion to grow its embedded insurance business by Kyle Wiggers originally published on TechCrunch